|

|

|

Arabi Gin

Cotton 'Links'

Market Data

News

Weather

Market Alerts

Resources

|

As China Shuns U.S. Ag Products, Make This 1 Trade Now

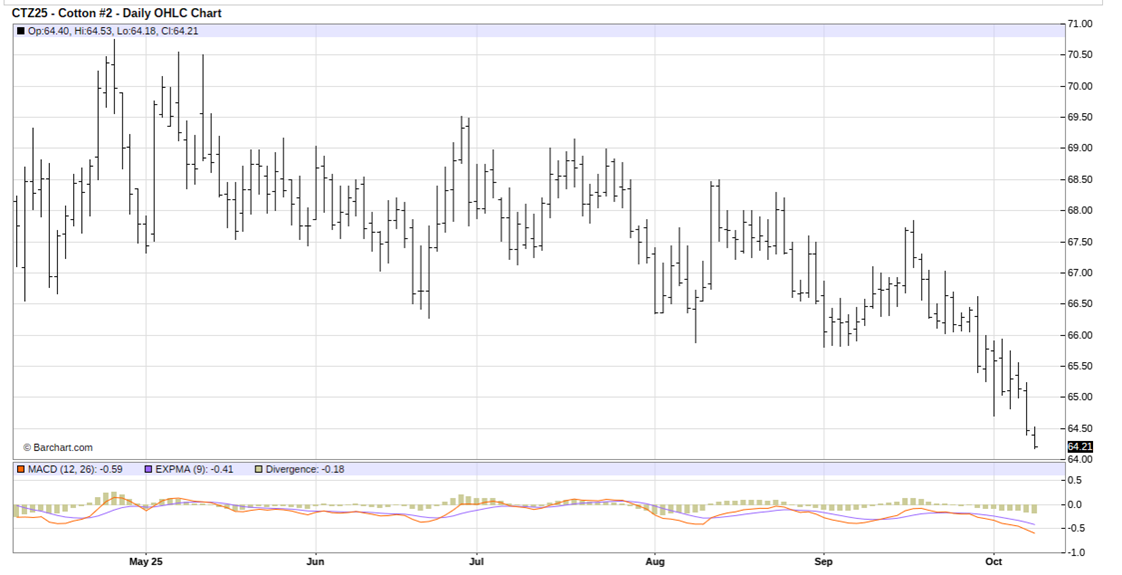

December cotton (CTZ25) futures present a selling opportunity on more price weakness. See on the daily bar chart for December cotton futures that prices are trending lower and have just hit a contract low. See, too, at the bottom of the chart that the moving average convergence divergence (MACD) indicator is in a bearish posture as the red MACD line is below the blue trigger line and both lines are trending lower. Cotton bears have the solid near-term technical advantage. Fundamentally, U.S.-China trade tensions have badly hurt the U.S. cotton market as China, a major cotton importer, has shunned buying U.S. ag products amid the trade tension. Also, the growing popularity of synthetic fiber use in apparel, especially active or athletic apparel, has reduced demand for cotton. A move in December cotton futures below chart support at 64.00 cents would become a selling opportunity. The downside price objective would be 60.00 cents or below. Technical resistance, for which to place a protective buy stop just above, is located at 66.00 cents.  IMPORTANT NOTE: I am not a futures broker and do not manage any trading accounts other than my own personal account. It is my goal to point out to you potential trading opportunities. However, it is up to you to: (1) decide when and if you want to initiate any trades and (2) determine the size of any trades you may initiate. Any trades I discuss are hypothetical in nature. Here is what the Commodity Futures Trading Commission (CFTC) has said about futures trading (and I agree 100%):

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|