|

|

|

Arabi Gin

Cotton 'Links'

Market Data

News

Weather

Market Alerts

Resources

|

Will Cotton Ever Rally?

I asked if cotton could break out of its bearish trend in an early August 2025 Barchart article, where I concluded:

October 2025 could be the perfect time to put cotton on your trading or investment radar for the coming year. Cotton prices edge lower in Q3 and over the first nine months of 2025, and are slightly lower in early Q4Cotton futures trade in the commodity asset class’s soft commodities sector. In Q3 2025, the nearby cotton futures edged 0.77% lower and fell 3.85% over the first nine months of 2025. The active month December cotton futures contract settled at 65.77 cents per pound on September 30, 2025.

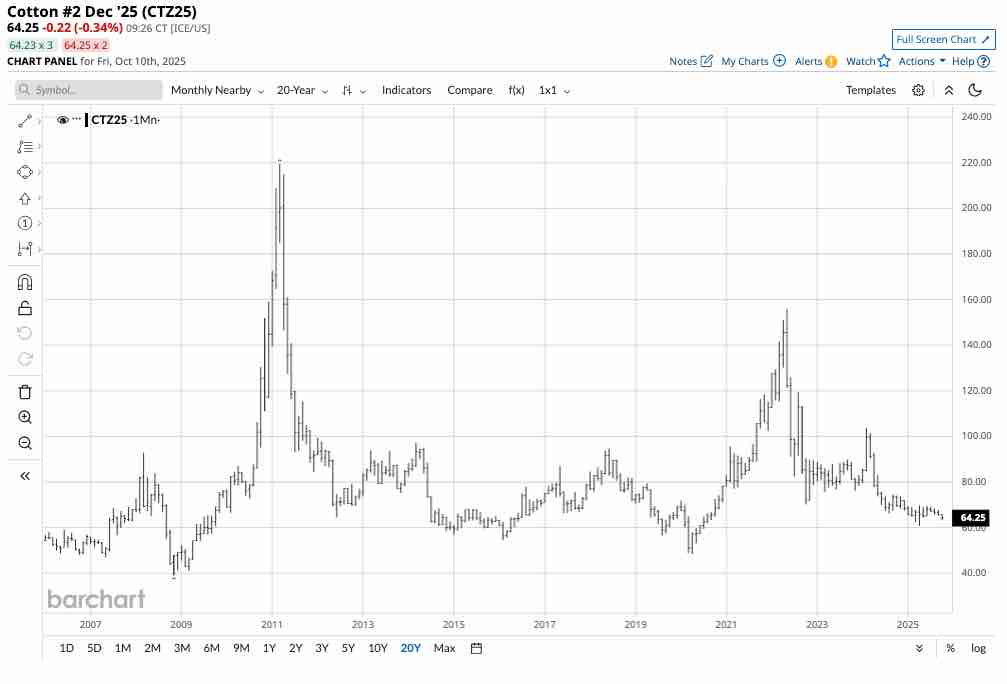

The monthly chart highlights the decline in cotton prices since the May 2022 high of $1.5595 per pound. Cotton futures reached a 60.80-cent low in April 2025. In October 2025, cotton was lower than the Q3 closing price at 64.25 cents. Meanwhile, the bearish trend remains firmly intact, with cotton futures within only 3.45 cents of the low from April 2025. Technical support is at the low from April 2025, with resistance at the September 2024 high of 74.55 cents per pound. Commodity cyclicality impacts the fundamental equationCotton could be a model for commodity cyclicality, which suggests that the cure for high prices is, in fact, those high prices, and the cure for low prices is, likewise, the low prices. Commodity prices tend to rise to levels where production increases, inventories grow, demand declines, and markets form price peaks, leading to downside corrections. In cotton, the rally to the high in May 2022 led to this phenomenon. Meanwhile, prices below 65 cents per pound could lead to the opposite impact in 2026, as production declines due to the low price, inventories begin to decrease, and demand increases, potentially creating a price bottom from which cotton futures can recover. The bottom line is that the cure for the high price in May 2022 was the price of over $1.55 per pound, and the cure for the current low price could be that cotton is trading and consolidating between 60 and 70 cents per pound before the 2026 growing season. Seasonality could favor cotton during the first half of 2026Most agricultural commodities experience seasonal highs and lows in prices, and cotton is no exception.

The chart highlights that three of the top five cotton-producing countries, responsible for 58.7% of global 2024 production, are in the northern hemisphere. The cotton price tends to reach annual highs during Q1 and Q2 each year as the uncertainty of the annual crop peaks.

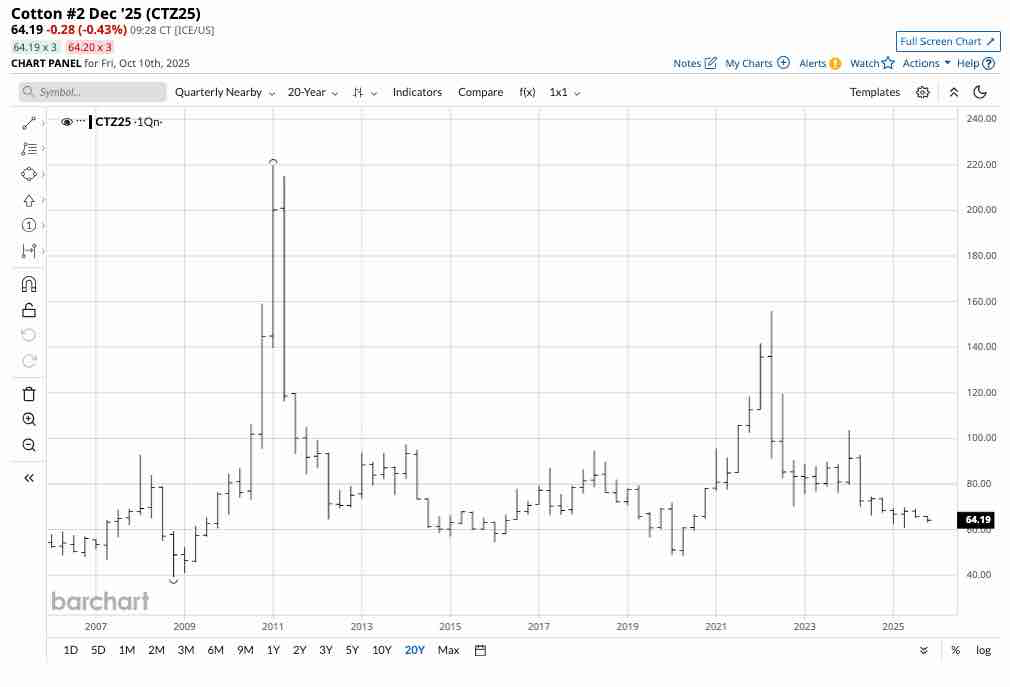

The quarterly cotton futures chart shows that cotton prices reached annual highs in Q1 or Q2 in 2008, 2011, 2014, 2015, 2016, 2017, 2018, 2019, 2020, 2021, 2022, and 2024. Seasonality and the current low price level favor a recovery in Q1 or Q2 2026. A scale-down buying approachAt below 65 cents per pound, cotton is at an attractive level to begin accumulating cotton futures for 2026, leaving plenty of room to add on further declines.

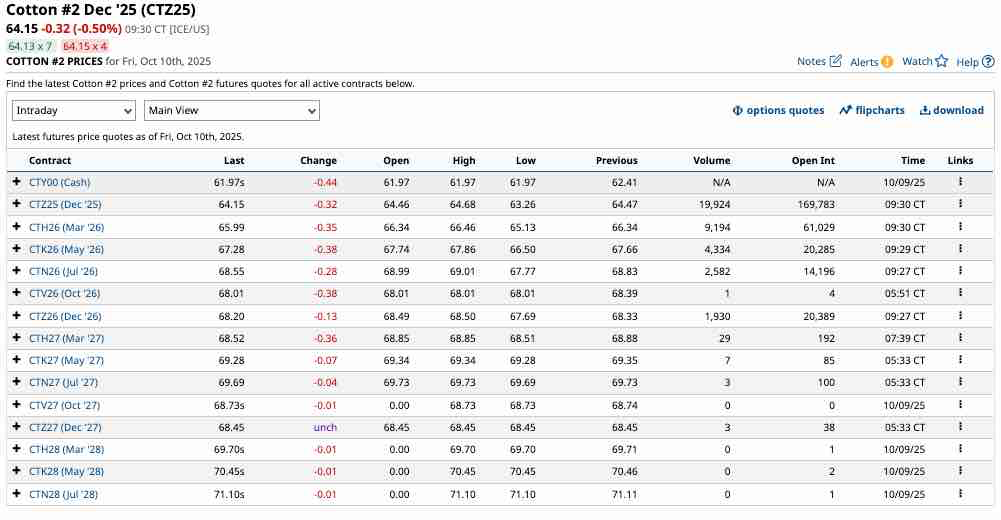

The forward curve shows that cotton for delivery throughout 2026 remains below 69 cents, with cotton for delivery in March and May 2026 under 68 cents per pound. The only path for trading or investment is the ICE futures marketThere are no cotton ETF or ETN products that track cotton futures prices since the BAL ETN ceased trading in June 2023. Each cotton contract contains 50,000 pounds of the fluffy fiber. At 66 cents per pound for March 2026 delivery, the value of an ICE cotton futures contract was $33,000. The ICE’s original margin requirement, currently at $1,507 per contract, allows a market participant to control $33,000 worth of cotton with a 4.57% down payment. If equity on a long or short risk position falls below $1,370 per contract, the exchange requires maintenance margin payments. Cotton is in the buy zone as commodity cyclicality and seasonality for Q1 and Q2 2026 favor a price recovery. I rate cotton a buy at a price below 70 cents per pound but will leave plenty of room to buy on a scale-down basis over the coming weeks and months. On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here. |

|

|